Giving

Why Give?

Transform Lives

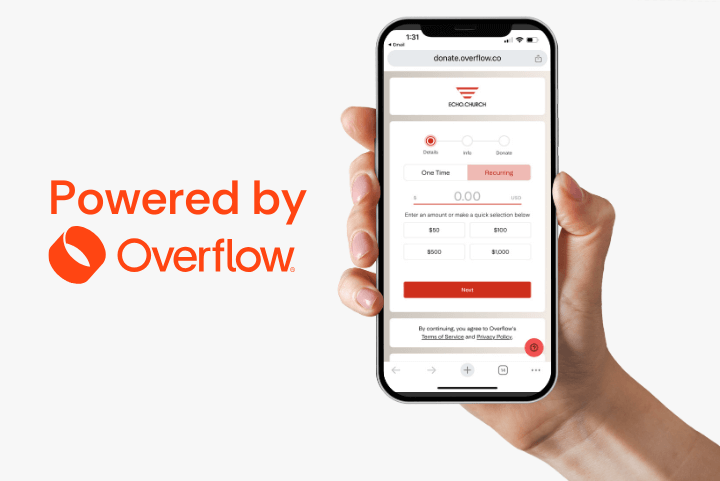

A New Giving Platform

We believe God is working through our church to make a significant impact in the Bay Area, and your generosity is key to making that vision a reality.

We believe God is working through our church to make a significant impact in the Bay Area, and your generosity is key to making that vision a reality.

As part of our commitment to steward resources wisely, we’re transitioning to a new giving platform called Overflow. Overflow’s lower processing fees will allow more of your contributions to go directly toward ministry initiatives, increasing our impact in this region and beyond.

If you previously automated your giving through PushPay, you’ll need to take action.

- You’ll receive an email from Overflow with a personalized link to transfer your giving details. Follow the link to update your payment method and activate your recurring gift.

- Cancel your existing gift in PushPay. See below for instructions.

To access your Overflow account, simply log in. You can see past contributions, recurring gifts, and change account settings.

Simple & Convenient Giving

With Overflow, you have more options for giving online. You can make a one-time gift or set up recurring giving through:

You can also give non-cash assets — simply and securely — in under five minutes.

90-Day Tithe Challenge

More Ways to Give

Mail a Check

1172 Murphy Ave.

Suite 130

San Jose, CA 95131

Legacy Gifts

Our Tax ID: 22-3979908

More About Giving

Overflow is a digital solution for giving non-cash assets, enabling you to give in the most tax-efficient way. Through Overflow, you can give:

- Via credit, debit, and ACH

- Stocks

- Cryptocurrency

- Donor advised funds (a specialized financial account used for charitable giving)

You’ll also have access to a private donor portal to view giving history, transaction statuses, and the ability to update connected financial accounts.

Overflow’s Information Security Program is SOC 2 Type 2 compliant and follows

strict criteria set forth by the SOC 2 Framework, a widely respected information security auditing procedure. Overflow does not have access to nor stores any brokerage account login information. For security and data privacy measures, Overflow uses Yodlee, a third-party provider, to handle the brokerage account login process. Over 600 companies

including PayPal, Mint, and Amazon use Yodlee to connect their clients’ accounts.

View Overflow’s frequently asked questions to learn more.

- Go to my.echo.church.

- Enter your username and password.

- Click Log In.

- Under Account Info (top right corner), click Giving History.

You can give any publicly-traded stock through Overflow.

Giving Appreciated Stock

Giving stock that you’ve held for over a year can save you up to 37% in federal income taxes based on the value of the charitable gift when itemizing deductions and protect your realized gains from being subjected to long-term capital gains tax, which can be up to 20%.

Consult with a tax professional to understand the full tax benefits of giving appreciated stock, including potential state tax savings.

Giving Company Stock Outside the Trading Window

If you received company-distributed stock as an employee and the trading window is not open, your brokerage will likely reject the transfer request. We suggest you ask your company for the trading windows and give during those time periods, which typically are open quarterly for three to four weeks at a time.

You can give through your bank’s online bill payment service. Your bank will send Echo.Church the payment, and we will add it to your giving record as if you had written a check yourself. Just indicate “Echo.Church” as your payee, specify your name as the account, and use the following information for the payee address:

Echo.Church

1172 Murphy Ave. Suite 130

San Jose, CA 95131

Allow 24 to 48 hours for your transaction to post to your giving record after we receive the check.

Once you’ve set up your recurring giving in Overflow, you’ll need to cancel your recurring gift in PushPay. Here’s how:

- Log in to PushPay.

- Click Home and type search for “echo church.”

- Select Echo.Church from the dropdown.

- On the right side of the page, click View under Recurring Payments.

- Click Actions above the gift you wish to cancel.

- Click Yes, Cancel on the popup.

Your Giving Records

Check your contribution records, automate your giving, or make changes to your profile.